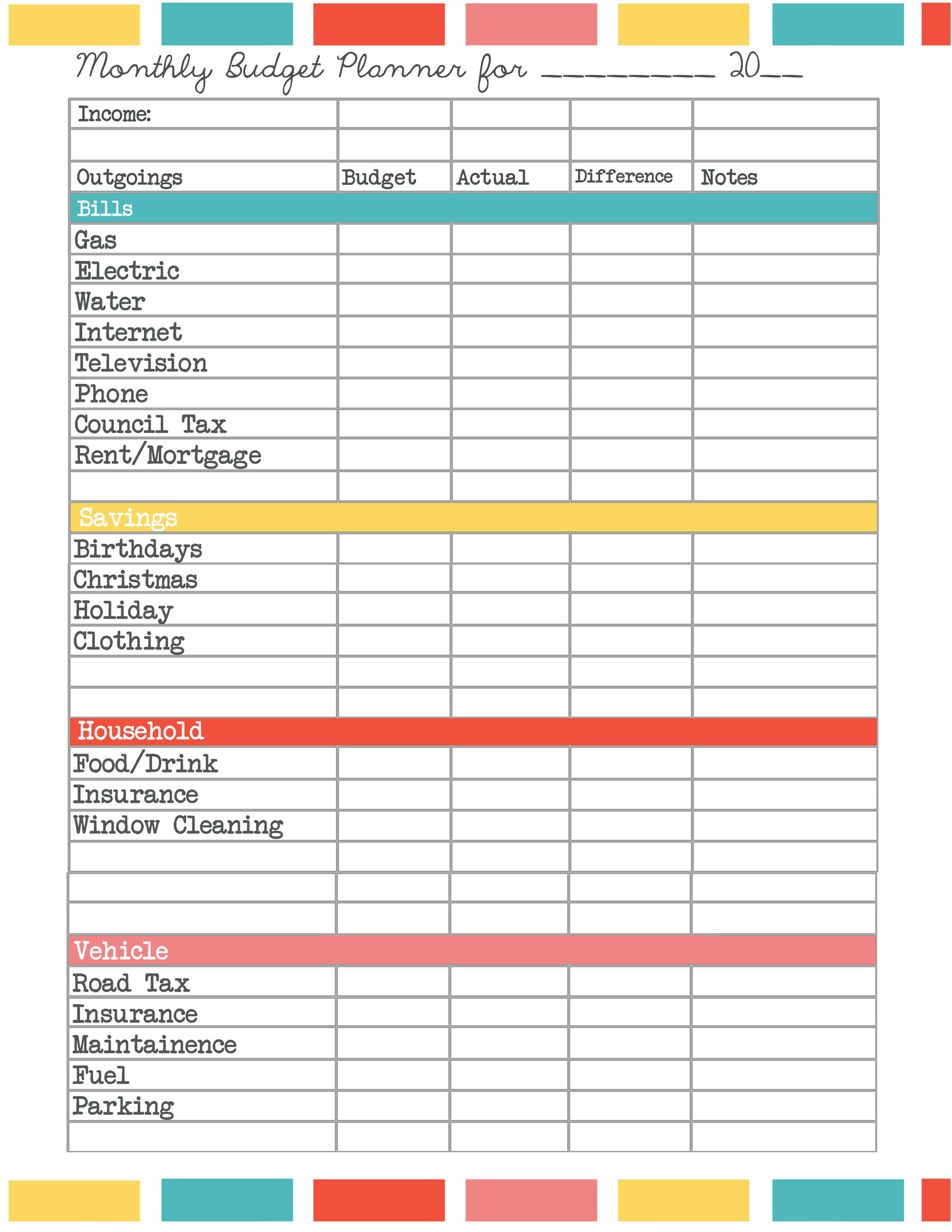

How to Create a Budget Spreadsheetīudget spreadsheets can help an individual track his spending and plan his future expenditure. For couples, it is important to be open to one another and include what hobbies or crafts you want to spend on. Come up with budget amounts.Īfter the first two steps, it is important to also create a budget for other necessities such as groceries, shopping, or date night. You can also indicate how much of the money left over you will allocate to each of the spending categories. For example, you may want to set a part of it aside for traveling or for an emergency fund. If there is, make a plan of what to do with the remainder instead of spending all of it on random things. Create savings goals.Īfter the total expenditure’s been deducted from the total income, check if there is any money left over. The same process is followed in computing for expenditure. Couples can add up their individual sources of income to come up with the final income amount. A personal budget spreadsheet should be separate from the budget spreadsheet for the household. It depends on the number of sources of your income and if there is anyone else in the house who will help with the expenditure. Put together all sources of income, as well as all expenses. Here, let us learn how to use the budget spreadsheet the easiest way. Some find it effective wherein they are actually able to track their expenditure, while some others don’t, which may be caused by several factors. There are many ways different people use budget spreadsheets. With a budget spreadsheet, money is managed, and every expense is allotted enough amount without exhausting the coffers.

It may very well be everyone’s best friend as it is the most helpful tool for organizing one’s finances in order to avoid falling into a debt hole. The above mentioned stakeholder organization is responsible for the distribution of this document.Updated MaWhat is a Personal Budget Spreadsheet?Ī personal budget spreadsheet offers an individual a way to determine the state of his finances and help him or her plan spending over the course of a period of usually a month or a year. CMHC stakeholders are permitted to distribute the materials at their expense. Neither CMHC and its employees nor any other party identified in this Article (Lender, Broker, etc.) assumes any liability of any kind in connection with the information provided. The information is believed to be reliable, but its accuracy, completeness and currency cannot be guaranteed. It does not provide advice, and should not be relied upon in that regard. The information is provided by CMHC for general illustrative purposes only, and does not take into account the specific objectives, circumstances and individual needs of the reader.

Sample household budget spreadsheet professional#

Ask your mortgage professional about CMHC. CMHC is Canada's largest provider of mortgage loan insurance, helping Canadians buy a home with a minimum down payment starting at 5%. Make sure you add these other costs when you fill out this form.įor more homebuying tips, visit CMHC's interactive Step by Step Guide. Note: You may have other costs not shown on this worksheet. DetailsĮntertainment, eating out, recreation, moviesĭental expenses, medical expenses, prescriptions, eye wear Use the following worksheet to help develop your budget. If you continue to spend more than you make, you must find ways to spend less. You should watch what you spend each month and see if you are getting closer to meeting your financial goals. Preparing a monthly budget - and sticking to it - is one of the keys to successful homeownership.

CMHC - home renovation financing options.Do I qualify for mortgage loan insurance?.CMHC licence agreement for the use of data.Residential Mortgage Industry Data Dashboard.COVID-19: CECRA for small businesses has ended.Insured Mortgage Purchase Program (IMPP).Default, claims and properties for sale.Default Management Request Submission Tool.Arrears Report Upload Tool - Coming 2022.Homeowner Business Transformation (HBT).Homeowner and small rental mortgage loan insurance.National Housing Strategy Project Profiles.

0 kommentar(er)

0 kommentar(er)